Tata Steel seals £500m UK support package but big job losses feared

Mark Sweney

Newsflash: The UK government has agreed a £500m support package for Tata Steel to secure the future of the Port Talbot steelworks, my colleague Mark Sweney reports.

Unions said the deal will have “devastating consequences”, with as many as 3,000 workers expected to lose their jobs.

India’s Tata group, which owns the vast steelworks in south Wales – Britain’s biggest – is also expected to inject about £725m to help it transition to greener production methods.

The country’s largest steel producer, which employs about 8,000 staff in the UK, with about half based at Port Talbot, had warned that it faced site closures if a financial support package could not be agreed.

Under the agreement, the government will provide a state aid package worth up to £500m to help switch Port Talbot’s two coal-powered blast furnaces to greener electric arc versions that can run on zero carbon electricity.

Here’s the full story:

Key events

Welsh Secretary David TC Davies says Wales’s steel industry now has a “bright future”:

Steelmaking remains a vital part of the Welsh economy and this huge support package from the UK Government ensures that the industry now has a bright future to match its long and proud history in South Wales.

We are investing in our steel industry as it makes the necessary transition to greener methods of production and are also putting support in place for the local workers affected by the changes.

Badenoch: this will save thousands of jobs in the long term

The UK government has declared that Welsh steel’s future has been secured by today’s deal with Tata, which will see taxpayers provide a £500m grant towards the £1.25bn cost of new greener furnaces.

The Department for Business and Trade says:

-

UK Government agrees proposal with Tata Steel to invest in greener steelmaking at Port Talbot, protecting the future of steel production and skilled jobs in Wales.

-

Transformational investment – including one of the largest UK Government support packages in history – would modernise production with state-of-the-art Electric Arc Furnace steelmaking and reduce UK’s entire carbon emissions by around 1.5%.

-

Without substantial investment, Port Talbot would otherwise be at serious threat and Tata Steel’s operations in the UK employing 8,000 people would be at risk.

-

Significant investment alongside Celtic Freeport will drive long-term green growth and create skilled jobs in South Wales and UK economies.

Business and Trade Secretary Kemi Badenoch (who began the week announcing a deal with BMW to save its Oxford car plant), insists the package with Tata will save jobs in the long run.

Badenoch says:

The UK Government is backing our steel sector, and this proposal will secure a sustainable future for Welsh steel and is expected to save thousands of jobs in the long term.

This is an historic package of support from the UK Government and will not only protect skilled jobs in Wales but also grow the UK economy, boost growth and help ensure a successful UK steel industry.

Tata Steel says it will soon start a consultation on its proposal and the transition period that will be needed.

This, it warns, will include a “potential deep restructuring for the carbon-intensive, unsustainable iron and steelmaking facilities at Port Talbot” – which unions fear will mean heavy job losses.

Many of the site’s existing ‘heavy end’ assets —such as blast furnaces and coke ovens—are reaching the end of their operational life, Tata adds.

Stephen Kinnock, Labour MP for the Welsh constituency of Aberavon, has warned that today’s deal with Tata Steel isn’t ambitious enough:

“While investment to decarbonise our Port Talbot steelworks is necessary and long overdue, I am deeply concerned that the UK Government is failing to deliver the just transition to green steel that my hardworking constituents deserve, not least because ministers have failed to adequately consult steel unions Community and GMB.

“At the heart of this failure is the narrow focus on electric arc furnace (EAF) technology, which will not only result in more job losses than necessary, but which simply cannot produce the qualities and grades of steel needed to meet the full spectrum of Tata’s customer base.

“Our European competitors are investing in a range of green steel-making capabilities in addition to EAFs – such as hydrogen, direct reduced iron and carbon capture – thus giving them the versatility that is needed to meet customer demand.

“The investment announced today may seem like a lot of money, but it pales in comparison to the investments made by European governments to competitor steel plants, meaning that British steelmakers are once again being made to compete with one hand tied behind their backs.

“We need a plan that both protects the current order book whilst also building for the future, but this plan comes up short on both counts.

“The deliberate exclusion of the steel unions from this whole process is also deeply disappointing.”

GMB: this will rip the heart out of the Port Talbot community

The GMB union fears that the deal between the UK and Tata Steel would be devastating for the steel industry and “rip the heart out” of the Port Talbot community that is dependent on the site.

Gary Smith, GMB General Secretary, says:

“This deal will have devastating consequences for jobs and workers. It will rip the heart out of the Port Talbot community.

For years, GMB has called for investment in this critically important industry. Instead of listening the government dithered and delayed until it is too late, and thousands of workers, their families and communities will pay the price.

Our country cannot be secure without a functioning domestic steel industry and workers must be at the heart of plans to modernise it.

Tata: it’s the largest investment in the UK steel industry for decades.

Today’s agreement with the UK government is “a defining moment for the future of the steel industry,” said Natarajan Chandrasekaran, chairman of Tata Group.

Tata says today’s deal to invest £1.25bn in “state-of-the-art electric arc furnace steelmaking” is the largest investment in the UK Steel Industry for decades.

Chandrasekaran explains it will create a decarbonisation pathway towards globally competitive and sustainable steel making in Port Talbot.

He adds:

“The proposed investment will preserve significant employment and represents a great opportunity for the development of a green technology-based industrial ecosystem in South Wales.”

Tata Steel seals £500m UK support package but big job losses feared

Mark Sweney

Newsflash: The UK government has agreed a £500m support package for Tata Steel to secure the future of the Port Talbot steelworks, my colleague Mark Sweney reports.

Unions said the deal will have “devastating consequences”, with as many as 3,000 workers expected to lose their jobs.

India’s Tata group, which owns the vast steelworks in south Wales – Britain’s biggest – is also expected to inject about £725m to help it transition to greener production methods.

The country’s largest steel producer, which employs about 8,000 staff in the UK, with about half based at Port Talbot, had warned that it faced site closures if a financial support package could not be agreed.

Under the agreement, the government will provide a state aid package worth up to £500m to help switch Port Talbot’s two coal-powered blast furnaces to greener electric arc versions that can run on zero carbon electricity.

Here’s the full story:

PA: Tata to consult over a “potential deep restructuring” alongside £500m state aid

Back in the steel industry, the PA news agency are reporting that Tata Steel is to receive up to £500m from the Government for investment plans at its Port Talbot steelworks, as we flagged this morning.

The money will help to install new electric arc furnaces for steelmaking at the site in Wales, which could be up and running within three years of getting regulatory and planning approvals.

But, Tata will also consult over a “potential deep restructuring”, which could mean significant job cuts at the site (reminder, there are fears that 3,000 jobs could be lost through a transition to greener production methods).

#Breaking Tata Steel is to receive up to £500 million from the Government for investment plans at its Port Talbot steelworks but will consult over a “potential deep restructuring”, sources have told the PA news agency pic.twitter.com/eYNCZRu6bt

— PA Media (@PA) September 15, 2023

In another transport dispute, railway catering workers have launched a 48-hour strike in a dispute over pay and pensions.

Members of the Rail, Maritime and Transport union (RMT) employed by Rail Gourmet on TransPennine Express services walked out on Friday until midnight on Saturday.

RMT general secretary Mick Lynch said:

“Rail Gourmet bosses are dragging their feet in this dispute.

“They are a profitable company who could easily pay the modest rise our members expect and deliver on sick pay and pensions.

“The company should be in no doubt that our members are determined to get a just settlement and will continue their industrial campaign for as long as it takes.”

Mick Whelan, ASLEF’s general secretary, explains that train drivers are striking in their ongoing dispute over pay.

‘While we regret having to take this action – we don’t want to lose a day’s pay, or disrupt passengers, as they try to travel by train – the government, and the employers, have forced us into this position.

Our members have not, now, had a pay rise for four years – since 2019 – and that’s not right when prices have soared in that time. Train drivers, perfectly reasonably, want to be able to buy now what they could buy four years ago.’

Whelan also criticises the government, and train operators, for not engaging with the union, saying:

‘Do you remember Where’s Wally? Well, what we want to know is Where’s Harper? We last saw the Secretary of State for Transport in December. We last saw Huw Merriman, the Rail Minister, in January. And we last saw the train companies in April.

Since then, nothing. Nada. Zilch. Not a letter, not an email, not a text message, not a phone call, not a WhatsApp. Not a word!’

More UK train strikes announced

Newsflash: UK train drivers are to hold two more days of stike action, coinciding with the Conservative party annual conference.

ASLEF, the train drivers’ union, has announced another two days of strike action – on Saturday 30 September and Wednesday 4 October.

That will dovetail with the Tory party conference, being held between Sunday 1 October and Wednesday 4 October in Manchester.

Aslef have also announced an overtime ban across the UK rail network on Friday 29 September and from Monday 2 to Friday 6 October, which will create further disruption.

Aslef says:

The strike will force the train operating companies to cancel all services and the ban on overtime will seriously disrupt the network as the privatised train companies have always failed to employ enough drivers to provide a proper service – the service they promise passengers, businesses, and the government they will deliver – without asking drivers to work their rest days.

The 16 companies affected include: Avanti West Coast; Chiltern Railways; c2c; CrossCountry; East Midlands Railway; Greater Anglia; GTR Great Northern Thameslink; Great Western Railway; Island Line; LNER; Northern Trains; Southeastern; Southern/Gatwick Express; South Western Railway; TransPennine Express; and West Midlands Trains.

Public satisfaction with Bank of England’s inflation strategy hits record low

Public satisfaction with the Bank of England’s strategy to battle inflation has fallen to a record low.

New quartetly data from the Bank shows that dissatisfaction over how it is “doing its job to set interest rates to control inflation” is at a record level.

Just 19% of those surveyed were satisfied with the BoE’s performance, while 40% were dissatisfied, giving a net satisfaction reading of -21.

That’s the worst on record, going back to 1999, beating the previous low of -13% set three months ago when the Bank last released this data.

Another 33% of people were ‘neither satisfied nor dissatisfied’ with the Bank, which has raised interest rates 14 times in a row since December 2021, to a 15-year high, while 9% didn’t know.

Inflation has cooled since last autun, dropping to 6.8% in July, but that’s still more than three times over the Bank’s 2% target.

David Hudson, restructuring advisory partner at FRP, fears more companies will collapse in the months ahead.

Reacting to today’s figures, showing a 19% year-on-year jump in insolvences in August, Hudson says:

“The coming year will bring more and more insolvencies as the damage from months of rising borrowing rates, falling demand and high inflation gradually feed through.

“Old challenges could still rear their head again too. As the mercury drops, higher costs for electricity, gas or fuel could return as a significant pressure on energy-intensive companies, particularly those in manufacturing. Altogether, this means that for much of UK Plc the watchwords will continue to be resilience and adaptation.

“An important emerging trend is a rise in compulsory liquidations. In many cases, these are a result of winding-up petitions against businesses from HMRC.

“After its leniency during the pandemic, we’ve seen the taxman become far more assertive in collecting outstanding liabilities. At a time when more businesses are struggling to settle tax debts due to cash and profitability pressure, a request to settle up can be an ask too far. The good news is that ‘time to pay’ arrangements can still be negotiated and secured with the right planning and preparation.”

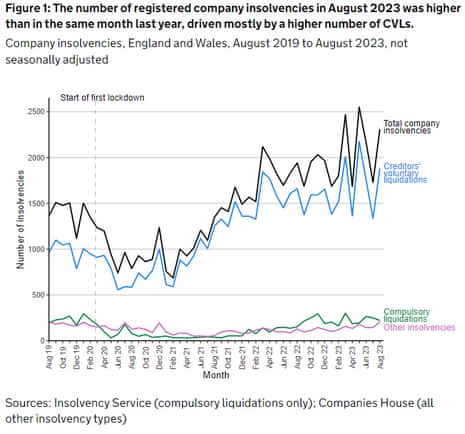

Company insolvencies jump 19% year-on-year in August

Newsflash: Company insolvencies in England and Wales have jumped by almost a fifth, year-on-year.

New figures just released by the Insolvency Service show there were 2,308 registered company insolvencies across England and Wales in August, which is 19% more than in August 2022.

The increase was driven by a rise in creditors’ voluntary liquidations (CVLs), in which a company is voluntarily wound up either by its directors or its shareholders. There were 1,880 CVLs last month, 13% higher than in August 2022.

The number of administrations was also higher than in August 2022.

And there were 221 compulsory liquidations in August, 45% higher than in August 2022 – this is where an insolvency procedure is started by a court order – a winding-up order.

The Insolvency Service says.

Numbers of compulsory liquidations have increased from historical lows seen during the coronavirus pandemic, partly as a result of an increase in winding-up petitions presented by HMRC.