UK a ‘stagnation nation’ at real risk of a recession, says Resolution

The UK is a ‘stagnation nation’ at real risk of a recession, says the Resolution Foundation thinktank.

Following today’s GDP report, James Smith, Research Director at the Resolution Foundation, explains:

“The UK economy has stagnated again in recent months, driven in part by the rapid rise in interest rates since late 2021. There is a real risk that the UK could fall into recession for the fourth time in 15 years.

“Britain is a stagnation nation that has struggled to secure sustained economic growth since the financial crisis. Addressing this is the central task we face as a country, and must be at the heart of the Chancellor’s Autumn Statement in 10 days’ time.”

Key events

Why shrinking real money growth could mean a recession

Today’s bigger picture is that UK GDP growth has run out of steam, explains Professor Costas Milas, of the Management School at University of Liverpool.

He tells us:

The Bank of England’s policymakers will argue, and rightly so, that monetary tightening is working.

What is worrying, however, is that the UK economy is “flirting” with recession. To see this, just “follow the money” not only to see what is happening to UK inflation but also to growth.

The Chart below plots real Divisia M4 (q-on-q4) growth together with real GDP (q-on-q4) growth. Real money growth affects GDP developments with long and variable lags. In fact, real money growth turned negative in mid-2022. Since then, real money has shrunk fast.

This is very likely to push the UK into recession by early 2024 and, therefore, interest rate cuts might happen earlier than the BoE’s policymakers (seem to) think.

UK GDP: latest reaction

Lydia Prieg, Head of Economics at the New Economics Foundation, says the UK remains the ‘sick man of the rich world’, following today’s GDP report showing no growth in July-September.

Prieg explains:

“Today’s growth figures tell the same old story: the UK is the sick man of the rich world. We have one of the weakest post-pandemic recoveries in the G7. Why? Because a lack of investment over the past decade made us a poorer nation today.

“We have some of the highest energy bills in the world, which means less money for people to spend in the shops. Why? Because this government did not invest in insulation and renewables. Our workforce is shrinking because falling investment in our NHS meant people are too sick to work. A lack of public investment in green industries and infrastructure has led to lower wages at home.

We need to invest to make the British people more prosperous. Invest in renewables and home insulation to get energy bills down. Invest in the NHS and schools so that healthy, well-educated adults can actually go to work. And invest in green industry and infrastructure to get growth and wages rising again.”

Henry Cook, senior economist at Japaness bank MUFG, says the broader picture remains one of stagnation, adding:

A recession has so far been avoided but growth has been muted for six quarters now.

Our base case is that growth will continue to trundle along a flat or weakly positive trajectory into 2024, with a good chance of a contraction in at least one quarter. Overall, we expect the broader picture of stagnation will remain in place next year with 2024 annual growth around 0.5%.

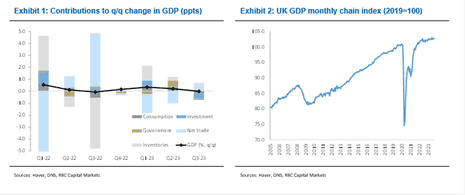

The headline figure of 0% growth masks a “very weak picture”, explains Cathal Kennedy, senior UK economist at RBC Capital Markets.

The main positive contribution to third quarter GDP came from net exports (see Exhibit 1), exports rising 0.5% q/q due in the main to a rise in services exports. Imports (reflecting weaker domestic demand, see below) on the other hand fell 0.8% q/q. Inventories also rose.

Domestic activity was very weak, however. Household consumption fell by 0.4% q/q, investment (GFCF) fell 2.0% q/q, government consumption was down 0.5% q/q. In the case of the latter two that was a reaction to idiosyncratic factors; strikes in health and education suppressing government consumption, the end of the super-deduction allowance at the end of March which had seen business investment pulled forward into Q2.

Heads-up: Microsoft has warned that some users in the UK and German may not be able to access its Microsoft 365 suite of products.

That potentially includes online versions of Word, PowerPoint, Excel, and OneNote.

We’re investigating an issue where some users in the UK and Germany may be unable to access Microsoft 365 services. We’re looking at diagnostic data to identify the underlying cause. For more details please look for MO688737 in the admin center.

— Microsoft 365 Status (@MSFT365Status) November 10, 2023

Full story: NatWest scraps more than £7.5m of Alison Rose’s payout after Farage scandal

Alison Rose will receive almost £1.75m from NatWest by next summer, 12 months after her resignation.

NatWest says:

The Board has confirmed that, in line with Ms Rose’s service agreement, payment of her fixed pay elements will be made for the remainder of her contractual notice period, which will end on 26 July 2024.

These contractual elements comprise salary, fixed share allowance and a pension allowance of 10% of salary and contractually agreed benefits in line with the terms of our approved Directors’ Remuneration Policy (DRP).

The total value over the remainder of the notice period is £1,748,142.

NatWest: Alison Rose foregoes £7.6m over Farage bank account row

Newsflash: NatWest has confirmed it is scrapping most of a potentially £10m-plus payout to Alison Rose, the banking group’s former chief executive.

Rose, who was forced to resign over a scandal linked to the closure of Nigel Farage’s bank accounts, is losing almost £7.6m of bonuses, unvested share awards and variable pay.

NatWest says it has not made any finding of misconduct against Rose, who was forced to resign over a leak to a BBC news journalist about the threatened closure of Nigel Farage’s bank account at Coutts, owned by NatWest.

But, Rose did not achieve “good leaver” status under the terms of its share award plan.

NatWest says:

Following the announcement that Ms Rose stepped down from her role by mutual agreement, it has been confirmed that good leaver status is not applicable under the relevant share plan rules.

Thus, unvested share awards worth £4.7m will lapse.

Rose will also not receive a bonus or variable remuneration for her work in 2023, before her resignation in late July. She could have received up to £2.86m, had she hit relevant performance conditions.

Economist Douglas McWilliams, the founder and deputy chairman of the CEBR, points out that growth over the last year is minimal once you account for rising population:

GDP flatlining Q3 and 0.6% up on a year earlier. Population is officially rising at 0.5% (and possibly more) so GDP per capita is up 0.1% year on year at best. @TheGrowthComm

— Douglas McWilliams (@DMcWilliams_UK) November 10, 2023

Analysis: UK economy continues sideways drift

Larry Elliott

Like a sailing ship trapped in the doldrums, Britain’s economy is going nowhere, our economics editor Larry Elliott writes:

The latest official growth figures for the third quarter of 2023 show the sideways drift of the past 18 months continuing. Without population growth the performance would have been even weaker.

Clearly, higher interest rates are having an impact. The UK economy is heavily reliant on the residential housing market to propel it forwards, and that engine has been shut off as a result of the steady increase in the cost of borrowing from the Bank of England since December 2021.

Residential investment, which is especially sensitive to changes in interest rates, fell by 1.7% in the three months to September and has now dropped for four successive quarters. Household spending also took a hit as consumers tightened their belts.

Here’s Larry’s full analysis:

Full story: UK economy flatlines in third quarter amid high interest rates

Phillip Inman

The UK economy flatlined between July and September, compared with the previous three months, as the impact of high interest rates and inflation weighed on consumers and businesses.

Zero growth in gross domestic product in the third quarter followed 0.2% growth in the second quarter, the Office for National Statistics said.

A slowdown in the property sector after a slump in house sales dragged down the services sector, while the transport sector also suffered a downturn, indicating that firms cut back on shipping goods across the country.

Most business surveys have shown falls in output and employment in recent months in reaction to falling consumer demand in the UK and elsewhere in Europe.

An increase in interest rates has dampened consumer spending, with many retailers signalling that they are prepared for a difficult festive period.

Inflation was unchanged at 6.7% in September, reducing the spending power of many workers who received pay rises below the consumer prices index.

Suren Thiru, the economics director at the Institute of Chartered Accountants in England and Wales, said:

“Flatlining quarterly UK GDP suggests that our economy lost momentum as the squeeze from inflation and higher borrowing costs suffocated output.”

More here:

Reeves: Conservatives have failed to deliver on economy

Shadow chancellor Rachel Reeves says:

The Conservatives have had thirteen years to deliver on the economy – and they have failed.

Growth is flatlining and Britain is worse off. Only Labour has a plan to make working people better off.

The Conservatives have had thirteen years to deliver on the economy – and they have failed.

Growth is flatlining and Britain is worse off.

Only Labour has a plan to make working people better off.

— Rachel Reeves (@RachelReevesMP) November 10, 2023

Handelsbanken: Damp weather and strikes capped UK economic activity

Getting back to the UK economy…. it’s worth remembering that damp weather and strikes both hit economic activity over the summer

James Sproule, chief UK Economist at Handelsbanken, says these factors need to be considered when assessing why the UK flatlined in the third quarter of the year.

Sproule says:

Firstly there were a number of public sector strikes in September, which will have dampened output. Secondly, the wet, albeit warm, weather that dominated the latter part of this past summer will have dampened consumption and put off shopping for the autumn.

The more positive news is that real earnings continue to increase, forecast to rise by 1% in Q4, and as such this should slowly boost consumer confidence (there is ample scope for improvement) and expenditure. Overall our view is that GDP is flat and that the inevitable minor variations we are seeing result in much talk of recession, but the broader picture is one of stagnation, a picture we see as remaining relevant through 2024.

China’s biggest lender ICBC hit by ransomware attack

A ransomware attack has caused disruption to the massive market in US government debt.

The US arm of Industrial and Commercial Bank of China (ICBC) was hit by a cyber attack that disrupted trades in the US Treasury market.

It’s the latest example of hackers disrupting a computer system and demanding a ransom, following attacks on Royal Mail and the Guardian over the last year.

China’s foreign ministry said today that ICBC is striving to minimise risk impact and losses after the attack.

Ministry spokesperson Wang Wenbin told a regular news conference:

“ICBC has been closely monitoring the matter and has done its best in emergency response and supervisory communication.”

The FT says the attack prevented ICBC from settling Treasury trades on behalf of other market participants, according to traders and banks, with some equity trades also affected.

Diageo shares drop 10% after profit warning

Shares in drinks company Diageo have tumbled 10%, after it issued a profits warning this morning.

Diageo, which makes Johnnie Walker whiskey, Tanqueray gin, Smirnoff vodka, Captain Morgan rum, Guinness stout and Baileys, told the City its performance in Latin America and Caribbean (LAC) had weakened.

Macroeconomic pressures in the LAC region are resulting in lower consumption and consumer downtrading, Diageo warned.

But in Europe, growth continues to be strong “despite geopolitical tensions escalating in the Middle East, where we are a leading spirits company”, Diageo adds.

Diageo now expects organic operating profit growth for the first half of the 2024 financial year to decline, compared to the first half of fiscal 23.

Victoria Scholar, head of investment at interactive investor, says:

While alcohol is typically viewed as a relatively economically resilient part of the market, shares in Diageo have struggled lately, down almost 20% year-on-year including today’s decline, which has sent the stock to the bottom of the FTSE 100 as consumer spending on drinks in bars, restaurants and clubs weakens in certain geographies.”

Stocks weaker in London

Shares have dropped in early trading in London, amid fears that interest rates have not yet peaked.

The FTSE 100 index of blue-chip shares has dropped by 0.66%, or 49 points, to 7406 points.

European markets are also lower, with the pan-European Stoxx 600 index down 0.5%.

Investors are jittery, after America’s top central banker warned last night that policymakers “are not confident” interest rates are high enough to bring inflation down to the Federal Reserve’s 2% target.

More happily, research institute the National Institute of Economic and Social Research expects the UK can avoid a recession, despite the lack of growth in the last quarter.

Paula Bejarano Carbo, NIESR’s associate economist, says:

“Today’s data indicate that GDP grew by 0.2% in September relative to August, driven mainly by growth in the services sector.

More broadly, GDP remained flat in the third quarter of 2023 relative to the second quarter, as services output fell by 0.1%, production output remained flat and construction output grew by 0.1%.

These figures are consistent with our forecast in our recent Autumn UK Economic Outlook, published earlier this week, in that the outlook for UK GDP growth remains sluggish and we do not expect a recession to ensue in the short or medium-term.”