Housebuilding slump triggers biggest drop in UK construction output since 2020

Newsflash: UK construction firms have suffered their steepest decline in output since May 2020.

Activity across the building sector shrank in September, the latest survey of purchasing managers at construction firms has found.

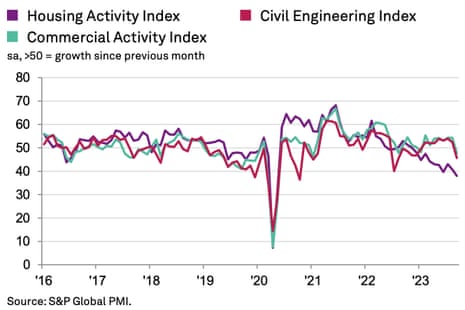

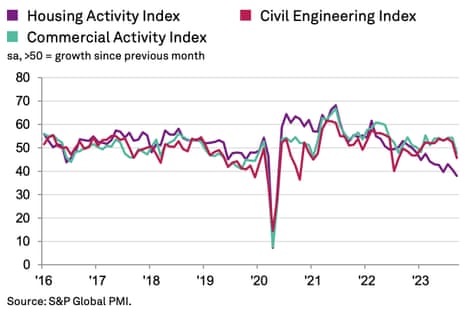

The decline was led by a “steep and accelerated fall in house building”, according to S&P Global who compile the report. Aside from the pandemic, the latest fall in housing activity was the steepest since April 2009 (when the global financial crisis pushed the UK into recession).

Shrinking order books contributed to another slowdown in employment growth and lower business activity expectations for the year ahead, the report shows.

It pulled the S&P Global / CIPS UK construction PMI index down to 45.0 in September, down sharply from 50.8 in August.

Any reading below 50 shows a contraction, and this is the fastest downturn since the first pandemic lockdowns hit the building sector.

Civil engineering activity also fell last month – a trend that could continue now that the northern leg of HS2 has been scrapped.

Tim Moore, economics director at S&P Global Market Intelligence, says:

“Output levels declined across the UK construction sector for the first time in three months during September and the latest downturn marked the worst overall performance since the early stages of the pandemic.

A rapid decline in house building activity acted as a major drag on workloads, with construction companies widely commenting on cutbacks to new residential development projects in the wake of sluggish demand and rising borrowing costs. Concerns about the domestic economic outlook also dampened client spending during September, which contributed to the fastest reduction in commercial building since January 2021.

The survey’s forward-looking measures once again remained relatively downbeat as order books decreased at an accelerated pace and business activity expectations eased to the lowest so far this year. Moreover, fewer project starts meant that sub-contractor availability increased to the greatest extent since the summer of 2009.

Lower demand across the supply chain contributed to a robust improvement in delivery times for construction productions and materials, alongside a stabilisation in purchasing costs during September.”

Key events

BoE’s Broadbent says it is an “open question” whether interest rates will rise further

The key question facing construction companies, mortgage holders and potential house buyers is whether UK interest rate have peaked, or will push higher.

Last month, the Bank of England left base rate at 5.25%, due to the slowdown in inflation.

And deputy governor Ben Broadbent has said today that it is an “open question” whether rates increase again at future BoE meetings, or not.

Speaking at a panel discussion hosted by the European Central Bank this morning, Broadbent says:

“I think over time, the normalisation of the terms of trade and the gradual effect, a continuing effect – even if interest rates won’t rise any further and that’s an open question … on our forecasts, it will be enough at least to assure that in two years we expect inflation to come down to the target.”

💥Bank of England Deputy Governor Ben Broadbent says it is an “open question” whether interest rates will increase further.

— Andy Bruce (@BruceReuters) October 5, 2023

(thanks to Reuters for the quote).

FT: Metro Bank bosses summoned by UK financial watchdogs

Metro Bank’s chair and chief executive have been summoned to urgent talks with the UK’s top financial regulators today, the Financial Times has reported.

They say:

Metro’s chief executive Daniel Frumkin and chair Robert Sharpe have both been asked to meet officials from the Bank of England’s Prudential Regulation Authority and Financial Conduct Authority later on Thursday, according to two people familiar with the situation.

The move comes after the bank’s share price plunged by up to 29% this morning, following the reports that it is seeking a capital injection.

As we flagged earlier (9.07am), Metro told shareholders this morning that it continues to meet its minimum regulatory capital requirements, and is considering a range of options to “enhance its capital resources”.

Today’s slump in construction output comes as housebuilders claim that England is now “the most difficult place to find a home in the developed world”.

The warning comes in a new snapshot of the housing crisis that also found a greater proportion of people in England live in substandard properties than the European Union average.

My colleague Rob Booth reports::

The Home Builders Federation (HBF), an industry group representing companies that build for private sale, found that England has the lowest percentage of vacant homes per capita in the Organisation for Economic Co-operation and Development (OECD), a group of 38 nations, including most of the EU the US, Japan and Australia.

It drew the comparisons before next week’s Labour party conference, as housebuilders again called for planning restrictions to be eased to accelerate construction.

About a quarter of private renters in the UK are also “overburdened” by housing costs – spending more than 40% of income, compared with just 9% in France and 5% in Germany, according to OECD data.

The fall in September’s construction PMI is the latest evidence that the UK economy was weak in the last quarter, says the EY ITEM Club.

They say:

-

The construction Purchasing Managers’ Index (PMI) joined its services and manufacturing peers by falling into contractionary territory in September.

A PMI of 45.0 was below the 50 ‘no-change’ mark for the first time in three months and adds to signs that the economy experienced a weak Q3.

-

The PMIs haven’t been a great guide to the official output measures in recent months, and the EY ITEM Club thinks the economy isn’t quite as soft as the survey measures suggest. But construction is particularly exposed to the adverse effects of higher interest rates on the property market.

Its performance therefore may well undershoot what is likely to be a period of near-stagnation for the economy as a whole.

RSM: Construction sector outlook hit by HS2 leg cancellation

“Disruption to government infrastructure projects”, which hit civil engineering activity, and the “continued slowdown in the housing market” both hurt construction output last month, says accountancy firm RSM.

Kelly Boorman, partner and national head of construction at RSM UK, warns the scrapping of HS2 to Manchester will change sentiment in the industry.

“This month’s fall in the headline PMI to 45 is the steepest drop in three years and does not come as a surprise, with the data finally catching up with sentiment on the ground. This follows prolonged slowdown in the residential market, the post-Covid lag after working through major backlogs of work, and this week’s government announcement that HS2 is being axed.

‘Long-term industry outlook is severely dampened due to the axing of HS2, with questions raised by the industry as to the timeline in re-allocating the £36bn to other infrastructure projects and the pace in which the projects can be procured and mobilised.

With government announcements that HS2 sites will create opportunity to build more regional and local affordable housing, this will help stimulate local communities and address housing targets. Many housebuilders however had planned for HS2 and acquired land and planning in line with this project and will need to re-visit to align with new local transport, connectivity and community project plans.

This exacerbates existing market fragility as interest rates and inflation continue to dry up housebuilders’ pipeline of activity.’

Many construction firms will be concerned by the axing of the northern leg of HS2 announced yesterday, reports Max Jones, director in Lloyds Bank’s infrastructure and construction team.

Jones says:

“Yesterday’s announcement regarding the future of HS2, the biggest infrastructure project in the UK, will be of concern to many contractors that have developed long-term plans based on the opportunities this would bring. Having said that, contractors are agile and will pivot to identify new opportunities from the £36bn which the government has identified for new transport projects in the North and Midlands.

“The construction sector lags the wider economy, so it faces a more challenging period as spending decisions from a few months ago filter through to pipelines. There is also some attention on whether there will be some consolidation within the sector, as well a focus on decisions on recruitment and retention, as businesses adjust to the current economic environment and plan for 2024 and beyond.”

The HS2 decision is still being digested in Westminster too, where there is criticism that Rishi Sunak recorded a video announcing yesterday’s decision several days ago, yet Downing Street and ministers repeatedly insisted no decision had been taken….

Andrew Sparrow’s Politics Live blog has all the details:

The construction sector now faces a “particularly tough” time until next spring, warns Joe Sullivan, partner at accountancy firm MHA.

Sullivan says we are seeing a “sustained slowdown” in UK construction, which will certainly not be helped by scrapping the western leg of HS2.

Commenting on the fall in the UK construction PMI in September, Sullivan says:

“September’s hold in the base rate didn’t weaken confidence further but it didn’t help either. Current interest rates push more homeowners onto expensive mortgages as their existing deals finish, weakening an already tepid housing market.

“We’re seeing a sustained deferral of work across the wider sector. Developers continue to mothball sites or slowdown their build rates, even in prime locations. Business owners in the supply chain must choose between keeping their skill base intact through taking on work at tighter margins, or layoffs, presenting problems when the upturn occurs.

“The period between now and the Spring will be particularly tough on activity. Insolvencies will rise and Michael J Lonsdale going into administration this week shows even the biggest businesses will be affected.

“Compounding the wider economic conditions is the scrapping of the western leg of HS2. At worst this move will take billions out of the sector. It also drives home that government must do better to provide visibility and certainty over the future so business owners can at least plan (for the worst) with confidence.”

The slump in house-building in September follows the steady rise in UK interest rates since December 2021, which has dampened demand from potential buyers.

Dr John Glen, chief economist at the Chartered Institute of Procurement & Supply (CIPS), says:

“The impact of high mortgage rates and low house buying demand continues to flow through the supply chain and negatively hit the UK construction industry. It has been a tough year for residential construction and the sharp decline in September shows the pressure on the sector is still a long way from easing, despite the pause on the raising of interest rates.

After some positive signs over the summer months, September saw a bump back down to earth for commercial construction as concerns over the future of the economy hampered demand and delayed new projects.

There is some comfort in the fact that the days of disrupted supply chains and soaring inflation are behind us for the time being, with delivery times continuing to fall and input prices remaining stable. The lack of activity has given space for suppliers to catch up with demand and create slack in the supply chain, which the construction sector will be hoping to take advantage of once demand returns.”

Housebuilding slump triggers biggest drop in UK construction output since 2020

Newsflash: UK construction firms have suffered their steepest decline in output since May 2020.

Activity across the building sector shrank in September, the latest survey of purchasing managers at construction firms has found.

The decline was led by a “steep and accelerated fall in house building”, according to S&P Global who compile the report. Aside from the pandemic, the latest fall in housing activity was the steepest since April 2009 (when the global financial crisis pushed the UK into recession).

Shrinking order books contributed to another slowdown in employment growth and lower business activity expectations for the year ahead, the report shows.

It pulled the S&P Global / CIPS UK construction PMI index down to 45.0 in September, down sharply from 50.8 in August.

Any reading below 50 shows a contraction, and this is the fastest downturn since the first pandemic lockdowns hit the building sector.

Civil engineering activity also fell last month – a trend that could continue now that the northern leg of HS2 has been scrapped.

Tim Moore, economics director at S&P Global Market Intelligence, says:

“Output levels declined across the UK construction sector for the first time in three months during September and the latest downturn marked the worst overall performance since the early stages of the pandemic.

A rapid decline in house building activity acted as a major drag on workloads, with construction companies widely commenting on cutbacks to new residential development projects in the wake of sluggish demand and rising borrowing costs. Concerns about the domestic economic outlook also dampened client spending during September, which contributed to the fastest reduction in commercial building since January 2021.

The survey’s forward-looking measures once again remained relatively downbeat as order books decreased at an accelerated pace and business activity expectations eased to the lowest so far this year. Moreover, fewer project starts meant that sub-contractor availability increased to the greatest extent since the summer of 2009.

Lower demand across the supply chain contributed to a robust improvement in delivery times for construction productions and materials, alongside a stabilisation in purchasing costs during September.”

UK car sales jump 21% in September

UK car sales have risen for the 14th month running, but the share taken by electric vehicles has fallen.

A total of 272,610 new cars were registered in September, industry body the SMMT reports, which is 21% more than a year ago.

There was a large increase in company car purchases, with registrations by large fleets up 40.8% to 143,256. The SMMT says this is due to “market rebalancing” after last year’s supply problems.

The SMMT also flags that battery electric vehicle sales rose by 18.9%, with 45,323 drivers choosing BEVs over fossil-fuel powered cars.

But as this growth was less than the overall recorded by the market, BEV market share slipped back slightly to 16.6% from 16.9% a year ago.

Mike Hawes, SMMT chief executive, says the government must offer more incentives to encourage motorists to switch to electric cars.

📢”A bumper September means the new car market remains strong despite economic challenges. However, with tougher EV targets for manufacturers coming into force next year, we need to accelerate the transition, encouraging all motorists to make the switch”@MikeHawesSMMT pic.twitter.com/hnldRunT48

— SMMT (@SMMT) October 5, 2023

Amazon: We disagree with Ofcom’s findings

Amazon says it disagrees with Ofcom, but has pledged to work constructively with the CMA over its probe into the cloud market.

An Amazon Web Services (AWS) spokesperson said in a statement:

“We disagree with Ofcom’s findings and believe they are based on a fundamental misconception of how the IT sector functions.”

The boss of a UK cloud computing company has welcomed Ofcom’s decision to refer the industry to the competition authorities.

Mark Boost, the CEO of Civo said:

“I applaud this bold action from Ofcom. A referral to the Competition and Markets Authority (CMA) is an unprecedented opportunity to make the cloud market a truly competitive space. This means empowering any company to develop and grow cutting-edge cloud services, and ensuring customers can readily move around to find the best solution to match their needs.”

“The CMA’s broad enforcement powers opens the door to wide-ranging remedies. Action will need to be a balancing act. It will be particularly important to tackle egress fees, either through significant price controls or the most ambitious choice: abolishing them entirely. The price point charged on egress by hyperscalers is out of control, and creates huge practical and financial obstacles for customers to move to another cloud provider. Urgent changes are also needed to how hyperscalers structure their services to enable customers to reap the benefits of simultaneously accessing multiple different providers, as well as a review of the fairness of incentives for loyal customers.”

“This is only the beginning of an 18 month journey before we know the decision made by the CMA. In the meantime, this investigation can also be a spur for immediate action from industry. Emerging cloud providers are rapidly stepping up to offer an alternative way forward to the hyperscalers. This vision is founded on putting the needs of the user back at the heart of cloud computing: transparent, predictable pricing; a streamlined experience; and super-fast, reliable services across the board.”