Introduction: Economy is caught in a trap, says Jeremy Hunt

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Britain is stuck in a ‘low-growth trap’, chancellor Jeremy Hunt has warned, after the Bank of England lifted interest rates to a 15-year high of 5.25% on Thursday.

The BoE also cut its growth forecasts yesterday, and warned that interest rates will remain “sufficiently restrictive for sufficiently long” to squeeze inflation out of the economy.

Hunt told Sky News that other advanced economies were also wedged in this trap saying:

It’s not just the UK, but Europe, the US, Canada, Japan…We’re all in a low-growth trap that we need to get out of.

The chancellor cited IMF forecasts that the UK’s long-term growth rates will be higher than France, Germany or Japan, but conceded “they’re not high enough.

Hunt points to the huge global shocks which have rocked the UK, including a 1970s-style energy crisis and a once in a century pandemic.

He pledges:

What you’ll see from me in the autumn statement, coming up, is a plan that shows how we break out of that low-growth trap and make ourselves into one of the most entrepreneurial economies in the world. That’s what we want.’

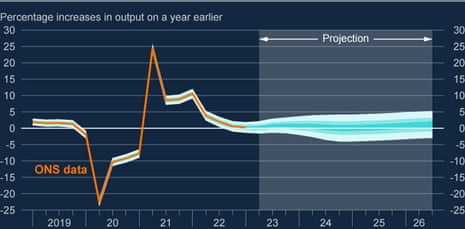

The Bank of England’s new growth forecasts are undoubedly poor.

It downgraded the outlook for GDP compared to its previous estimates released in May, particularly during 2024 and at the beginning of 2025.

Dr Linda Yueh, economics fellow at Oxford University, says the BoE’s forecasts are so dire she thought there was a typo in them.

She told Radio 4’s Today programme:

I thought there was a one missing. Growth is normally at least 1%. But the bank has said in 2024-2025, the growth rate is going to average only 0.25%.

It’s a quarter of a percent increase in national output, or national income. I thought it would be at least 1.25%

This is why the chancellor Jeremy Hunt says we’re at risk of being stuck in a low growth equilibrium.

High interest rates will not help the UK economy to grow, of course, as the Bank tries to bring inflation down. It expects consumer inflation to “fall markedly further this year”, but CPI isn’t expected to hit its 2% target until early 2025.

Governor Andrew Bailey cautioned it was too early to say when UK interest rates may start to be cut, saying:

“Inflation is falling and that’s good news. We know that inflation hits the least well-off hardest and we need to make sure that it falls all the way back to the 2% target.,

“That’s why we’ve raised rates to 5.25% today.”

Also coming up today

The US economy will be in focus this afternoon, when July’s jobs figures are released.

Economists predict around 200,000 new jobs were created in America last month, slightly down on June’s 209,000, with the unemployment rate is seen steady at 3.6%.

A strong jobs report could prompt further increases in US interest rates, while a poor report could encourage the Federal Reserve to stop its tightening cycle.

The agenda

-

8.30am BST: Eurozone construction sector PMI index

-

9am BST: UN monthly food price inflation report

-

9am BST: UK new car sales for July

-

9.30am BST: UK construction sector PMI index

-

1.30pm BST: US Non-Farm Payroll jobs report for July

Key events

World food prices rise in July

Joanna Partridge

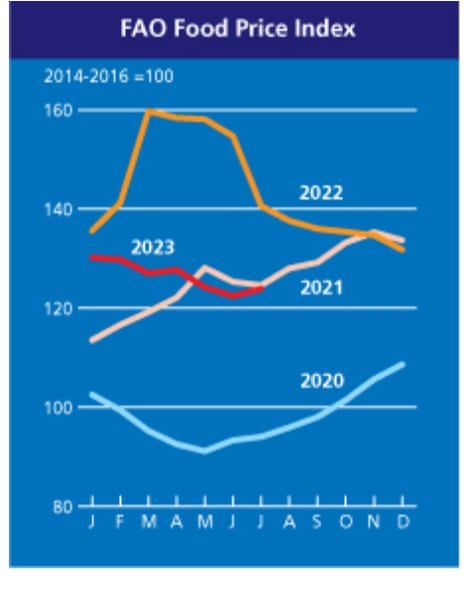

The price of essential ingredients is rising again around the world as the ongoing conflict in Ukraine, political events, and unpredictable weather are impacting crops and the transport of foodstuffs such as cereals.

The rice price index hit its highest level in almost 12 years in July, after rising 2.8% last month alone, according to the UN’s international food price index. The increase came after India banned exports of non-basmati white rice on 20 July, in a bid to curb domestic food inflation after heavy rains hit crops in the world’s largest exporting nation.

The UN’s Food and Agriculture Organization (FAO) said the move had amplified “upward pressure already exerted on prices by seasonally tighter supplies and Asian purchases.”

Rice prices have continued to climb on global commodity markets in recent days, with exporters reporting that Indian parboiled prices hitting a record high this week, as demand shifted to this grade, which is not subject to export restrictions.

Traders in Thailand and Vietnam, the world’s second and third largest rice exporting countries, have also been looking to re-negotiate prices of August rice shipments, Reuters reported earlier this week, to take advantage of rising prices.

The cost of wheat also made their first monthly climb in nine months in July, the UN FAO found, because of uncertainty about Ukrainian grain exports since Russia decided to terminate the Black Sea grain deal last month, which had guaranteed safe shipment from Ukraine’s sea ports. Russia’s subsequent attacks on Ukrainian port infrastructure on the Black Sea and Danube river pushed international wheat prices up by 1.6% last month according to the UN food price index.

The price of vegetable oils soared by 12% last month compared with June, marking the first increase after seven months of falls, as international prices of sunflower, palm, soy and rapeseed oils all rose. Sunflower oil prices surged by 15% month-on-month over worries about exporting the product out of Ukraine.

Lengthy spells of dry weather in large producers Canada and the US have also added pressure to wheat prices.

Overall, international food prices rose slightly – by just 1.3% – in July, and remain some 12% lower than the FAO’s food price index a year earlier, as the cost of sugar slid, and there were small falls in the prices of dairy and meat, all of which should ease some pressures on consumers amid stubbornly high food price inflation in many countries.

Two-year fixed mortgage rates unchanged

The latest daily mortgage rates are out….

Moneyfacts reports that the average 2-year fixed residential mortgage rate today is 6.85%.

This is unchanged from the previous working day – and indeed unchanged since Tuesday, when it rose from Monday’s 6.81%.

There is a little relief for those seeking longer-term fixed rates, though.

The average 5-year fixed residential mortgage rate today has dropped to 6.35%, down from 6.36% on Thursday.

We’ll find out on Monday if there has been more reaction to yesterday’s interest rate rise.

UK house-building falls again as rate hikes hit demand

UK housebuilding continued to fall last month as high interest rates hit demand, a new survey of the sector shows.

Data firm S&P Global has reported that there was another sharp fall in house building last month, as new orders were constrained by rising borrowing costs.

Its construction Purchasing Managers’ Index (PMI) has recovered to 51.7, its highest level since February, and up from June’s five-month low of 48.9.

But a sub-index measuring the house-building sector picked up to 43.0 from June’s 39.6, still well below the 50-point mark showing stagnation.

The report shows that residential construction work have now fallen for eight consecutive months.

Construction companies noted that rising borrowing costs had led to fewer sales enquiries and slower decision-making among clients in July.

Tim Moore, economics director at S&P Global Market Intelligence, explains:

July data indicated that some parts of the UK construction sector gained momentum, notably commercial building and civil engineering activity. This led to a renewed rise in total construction output which, although modest, was the fastest for five months. Survey respondents commented on increased infrastructure work, office refurbishments, and resilient demand for a range of commercial projects.

Meanwhile, another steep reduction in house building acted as a severe constraint on construction growth. Around 35% of the survey panel reported a decline in residential work during July, while only 18% signalled a rise. Lower volumes of housing activity have been recorded in each month since December 2022, with construction companies widely reporting subdued sales due to rising interest rates and worries about the economic outlook.

UK car sales hit full year of non-stop growth.

Despite rising interest rates, and the cost of living crisis, UK car sales have now risen for 12 months in a row.

Trade body the Society of Motor Manufacturers and Traders has just reported that the new car market grew 28.3% in July with 143,921 new vehicles registered.

This means the market has posted non-stop growth for a full year despite “challenging economic conditions”, SMMT says.

Sales of battery-powered electric vehicles are up almost 88% year-on-year, with just over 23,000 new BEVs registered in July.

Mike Hawes, SMMT chief executive, said:

Choice and innovation in the market are growing, so it’s encouraging to see more people switching on to the benefits of driving electric.

With inflation, rising costs of living and a zero emission vehicle mandate that will dictate the market coming next year, however, consumers must be given every possible incentive to buy.

Government must pull every lever, therefore, to make buying, running and, especially, charging an EV affordable and practical for every driver in every part of the country.

The SMMT has raised its forecst for overall new car registrations this year by 0.9%, to 1.847m.

But, the outlook for 2024 has been downgraded by 0.7% to 1.951m, “reflecting wider concerns about the cost of living.”

Generali Investments fears that the UK economy will stagnate this year.

Christoph Siepmann, senior economist at Generali Investments, explains:

While acknowledging that GDP growth held up better that previously expected, it nevertheless revised growth down 0.5% in 2024 (from +0.75%) and to 0.25% in 2025 (from 0.75%).

We are still more pessimistic for this year and expect a stagnation.

Generali also predict UK interest rates will peak at 5.75%, and think they could be kept there at least until mid-2024.

As we covered yesterday, the Bank of England’s decision to raise interest rates by a quarter of one percent was not unanimous.

One of its nine policymakers, Swati Dhingra, opposed increasing borrowing costs as the risks of overtightening had continued to build.

Two policymakers, Catherine Mann and Jonathan Haskel, pushed for a larger increase to 5.5%, arguing that private sector wage growth was trending higher, adding to inflationary pressures.

Paul Donovan, chief economist of UBS Global Wealth Management, says the decision offers “a valuable international lesson”.

Yesterday’s decision had votes for unchanged rates, a 0.25pps hike, and a 0.50pps hike.

One of the unfortunate realities of modern life is that structural change and the aftershocks of the pandemic means we have less understanding of how any economy is performing in real time, widening the spectrum of opinion about what has to happen next.

Interest rates: What the papers say

The 14th increase in UK interest rates in a row, yesterday, makes the front page of many newspapers this morning.

The Guardian highlights the calls from Conservative MPs for tax cuts to help the economy:

Jeremy Hunt’s warning that the UK is stuck in a low-growth trap is on the front of The Times, which also says some analysts think UK interest rates could rise as high as 6%.

The Financial Times flags the Bank’s warning that borrowing costs are likely to remain elevated despite slowing inflation.

The i points out that millions of households face huge rises in their mortgage payments if interest rates remain high over the next few years:

Predictions that Britain’s era of cheap food has come to an end make the front of the Daily Telegraph:

Here’s a grim example of Britain’s low-growth trap, from economics professor Jonathan Portes:

(usual caveats. This isn’t a proper analysis: 2008 was a peak, 1993 was early in a recovery. And most other advanced economies esp in Western Europe will also have slowed sharply. Still, even though I knew it was bad, didn’t think it was this bad.)

— Jonathan Portes (@jdportes) August 4, 2023

The Bank of England’s warning yesterday that interest rates will stay high for longer than many had hoped is a blow to Rishi Sunak, as he weighs up when to call an election.

As things stand, Sunak faces heading to the polls with the economy barely growing, and borrowing costs painfully high.

Sir John Redwood, a Conservative MP and former cabinet minister, argued that “targeted tax cuts would be extremely helpful” from the Treasury but said his main criticisms were directed at the Bank for lurching from low interest rates creating inflation to rates that “cause a housebuilding collapse and manufacturing recession”.

Here’s the full story:

Reeves: Rate rise is ‘hammer blow’ for workers

Shadow chancellor Rachel Reeves has labelled yesterday’s rise in interest rates a “hammer blow for working people” which, she argues, did not need to happen.

Writing in the Daily Mirror, the shadow chancellor said the Government is “managing decline rather than getting us moving”.

She wrote:

“This rise – a hammer blow for working people – did not have to happen.

“The Tories crashed the economy with last September’s disastrous mini-Budget and left you paying the price.”

Reeves says Labour has a plan to improve the economy:

First, we’d make sure the banks provide support to mortgage holders who are struggling with repayments.

Second, we would introduce a proper windfall tax on the huge profits the oil and gas giants are making because of Russia ’s invasion of Ukraine and use that money to help families with the cost of living.

And third, we would put in place a long-term plan to secure and grow our economy.

Interest rates rising again will come as a hammer blow for working people.

After so much Tory economic damage, delivering change will not come easily.

But I know that only Labour’s plans can deliver it.

My @DailyMirror piece today.https://t.co/jSOyN0aONn

— Rachel Reeves (@RachelReevesMP) August 4, 2023

Introduction: Economy is caught in a trap, says Jeremy Hunt

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Britain is stuck in a ‘low-growth trap’, chancellor Jeremy Hunt has warned, after the Bank of England lifted interest rates to a 15-year high of 5.25% on Thursday.

The BoE also cut its growth forecasts yesterday, and warned that interest rates will remain “sufficiently restrictive for sufficiently long” to squeeze inflation out of the economy.

Hunt told Sky News that other advanced economies were also wedged in this trap saying:

It’s not just the UK, but Europe, the US, Canada, Japan…We’re all in a low-growth trap that we need to get out of.

The chancellor cited IMF forecasts that the UK’s long-term growth rates will be higher than France, Germany or Japan, but conceded “they’re not high enough.

Hunt points to the huge global shocks which have rocked the UK, including a 1970s-style energy crisis and a once in a century pandemic.

He pledges:

What you’ll see from me in the autumn statement, coming up, is a plan that shows how we break out of that low-growth trap and make ourselves into one of the most entrepreneurial economies in the world. That’s what we want.’

The Bank of England’s new growth forecasts are undoubedly poor.

It downgraded the outlook for GDP compared to its previous estimates released in May, particularly during 2024 and at the beginning of 2025.

Dr Linda Yueh, economics fellow at Oxford University, says the BoE’s forecasts are so dire she thought there was a typo in them.

She told Radio 4’s Today programme:

I thought there was a one missing. Growth is normally at least 1%. But the bank has said in 2024-2025, the growth rate is going to average only 0.25%.

It’s a quarter of a percent increase in national output, or national income. I thought it would be at least 1.25%

This is why the chancellor Jeremy Hunt says we’re at risk of being stuck in a low growth equilibrium.

High interest rates will not help the UK economy to grow, of course, as the Bank tries to bring inflation down. It expects consumer inflation to “fall markedly further this year”, but CPI isn’t expected to hit its 2% target until early 2025.

Governor Andrew Bailey cautioned it was too early to say when UK interest rates may start to be cut, saying:

“Inflation is falling and that’s good news. We know that inflation hits the least well-off hardest and we need to make sure that it falls all the way back to the 2% target.,

“That’s why we’ve raised rates to 5.25% today.”

Also coming up today

The US economy will be in focus this afternoon, when July’s jobs figures are released.

Economists predict around 200,000 new jobs were created in America last month, slightly down on June’s 209,000, with the unemployment rate is seen steady at 3.6%.

A strong jobs report could prompt further increases in US interest rates, while a poor report could encourage the Federal Reserve to stop its tightening cycle.

The agenda

-

8.30am BST: Eurozone construction sector PMI index

-

9am BST: UN monthly food price inflation report

-

9am BST: UK new car sales for July

-

9.30am BST: UK construction sector PMI index

-

1.30pm BST: US Non-Farm Payroll jobs report for July