UK mortgage approvals jump unexpectedly

Newsflash: UK mortgage approvals rose unexpectedly last month, despite borrowers being hit by rising interest rates.

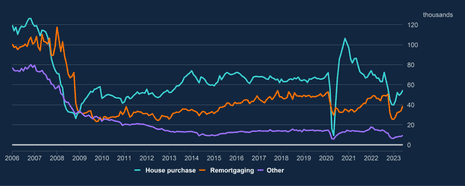

New data from the Bank of England shows that net mortgage approvals for house purchases rose to 54,700 in June, up from 51,100 in May. Economists had expected a fall to around 49,000.

Approvals for remortgaging rose from 34,100 to 39,100, suggesting homeowners tried to nail down new deals before rates hit new highs.

The BoE, which has raised interest rates 13 times in a row, reports that the ‘effective’ interest rate – the actual interest rate paid – on newly drawn mortgages rose again in June, up 7 basis points to 4.63% (from 4.56%).

The rate on the outstanding stock of mortgages increased by 10 basis points, to 2.92%.

Today’s report also shows that net borrowing of mortgage debt by individuals rose by £100m in June, after people repaid £100m in May and made record high net repayments of £1.1bn in April.

Mortgages people

Bank of England

Net borrowing of mortgage debt by individuals increased to £0.1 billion in June, after net repayments of £0.1 billion in May and record high net repayments of £1.1 billion in April— Shaun Richards (@notayesmansecon) July 31, 2023

Key events

The jump in mortgage approvals in June shows that the housing market is more resilient than expected, says Jeremy Leaf, north London estate agent.

Leaf says:

’Write the housing market off at your peril. Showing considerable resilience again, mortgage approvals are still on the up despite the inevitable time lag in these figures, reflecting activity a few months ago when the market was still recovering from post-mini-Budget blues.

‘What we are finding on the ground is that since the succession of interest rate rises over the past few months, proceedable buyers are taking more time to weigh up the greater choice of available properties.

They are also carrying out their own stress testing before taking advantage of their stronger position in the market.’

Despite June’s surprise pick-up in activity, the UK mortgate and housing sector will remain weak in the months ahead, predicts Ashley Webb, UK economist at Capital Economics.

Webb explains:

The net monthly change in mortgage lending improved a touch in June, up from -£0.1bn in May (i.e. repayments were greater than new loans) to +£0.1bn.

And mortgage approvals rose a bit further, from 51,100 in May to 54,700 in June. That said, approvals still remain well below the pre-pandemic average of 66,000.

The interest rate on newly drawn mortgages rose by another 7bps, from 4.56% to 4.63%. Admittedly, the lower-than-expected CPI inflation data for June probably signalled the end of the upward march in mortgage rates. But our view that the Bank will keep rates high until the second half of next year means mortgage rates are likely to plateau rather than fall.

That suggests mortgage lending and housing activity will remain weak over the coming months.

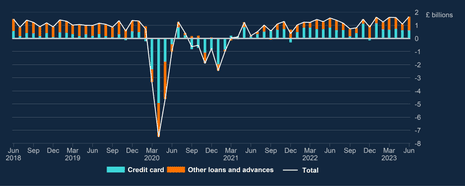

Biggest jump in consumer lending since April 2018.

Consuner credit also jumped last month, at the fastest rate in five years, as households struggle to pay bills.

Net borrowing of consumer credit by individuals increased to £1.7bn in June, the highest since April 2018, the Bank of England reports, following a £500m drop in May.

Borrowing on credit cards remained stable at around £600m, the Bank says.

But borrowing through other forms of consumer credit, such as car finance deals and personal loans, increased “significantly” from £500m in May to £1bn in June.

Chart: mortgage approvals rise

Here’s a chart showing how UK mortgage approvals rose unexectedly last month:

UK mortgage approvals jump unexpectedly

Newsflash: UK mortgage approvals rose unexpectedly last month, despite borrowers being hit by rising interest rates.

New data from the Bank of England shows that net mortgage approvals for house purchases rose to 54,700 in June, up from 51,100 in May. Economists had expected a fall to around 49,000.

Approvals for remortgaging rose from 34,100 to 39,100, suggesting homeowners tried to nail down new deals before rates hit new highs.

The BoE, which has raised interest rates 13 times in a row, reports that the ‘effective’ interest rate – the actual interest rate paid – on newly drawn mortgages rose again in June, up 7 basis points to 4.63% (from 4.56%).

The rate on the outstanding stock of mortgages increased by 10 basis points, to 2.92%.

Today’s report also shows that net borrowing of mortgage debt by individuals rose by £100m in June, after people repaid £100m in May and made record high net repayments of £1.1bn in April.

Mortgages people

Bank of England

Net borrowing of mortgage debt by individuals increased to £0.1 billion in June, after net repayments of £0.1 billion in May and record high net repayments of £1.1 billion in April— Shaun Richards (@notayesmansecon) July 31, 2023

UK fixed-term mortgage rates are unchanged today, as hopes build that borrowers will see better deals soon.

Financial data provider Moneyfacts reports that:

-

The average 2-year fixed residential mortgage rate today is 6.81%. This is unchanged from the previous working day.

-

The average 5-year fixed residential mortgage rate today is 6.34%. This is unchanged from the previous working day.

Last week, several large lenders cut rates on their fixed mortgage deals last week, in a sign of mounting expectations that the Bank of England may be nearing the end of an aggressive cycle of interest rate rises.

The City currently expects Bank rate to peak at 5.75% next spring, up from 5% today, but lower than the 6.5% forecast at the start of this month.

Speaking of oil… Goldman Sachs yesterday revised up its forecast for global oil demand for this year.

Goldman analysts estimate that global oil demand climbed to an all-time high of 102.8 million barrels per day (bpd) this month.

Solid demand is expected to create a larger-than-expected 1.8 million bpd deficit in the second half this year, and a 0.6 million bpd deficit in 2024.

Goldman is also sticking with its forecast that Brent crude will trade at $93 per barrel in 12 months time (up from $84/barrel today).

Goldman “A Less Pessimistic Oil Market; Sticking to our 12M $93 Brent Target” #oott

The return to deficits in July, following a surplus averaging 0.6mb/d in the prior 12 months, has driven much of the rally in timespreads. We estimate that the rise in demand to a record high… pic.twitter.com/mp9mUfo6ax

— Stephen Innes 🇨🇦 🇹🇭 (@steveinnes123) July 31, 2023

It pointed to the reduced risk of a global recession, and Opec’s efforts to push up prices by cutting supplies.

Global education group Pearson has reassured investors that it is on track to hit its sales and profit targets this morning.

Strong demand for English language learning, exams and qualifications have helped Pearson to beat market expectations, as it reported 44% growth in profit in its first half of the year this morning.

Victoria Scholar, head of investment at interactive investor, has the details:

“Pearson reported adjusted operating profit in the first half up 44% to £250 million while sales increased by 5% to £1.8 billion. Assessment and qualifications sales were a bright spot with sales up 7% along with workforce skills sales up 9% and English language learning sales up 44%. However virtual learning sales fell by 15% and high education sales fell by 2%. The education publisher said it is confidence about achieving its full-year expectations.

Pearson has been repositioning itself towards digital education services and is harnessing artificial intelligence to support its Pearson+ service as well as other technological tools. It has also been focusing on upskilling and reskilling demand which have all helped to boost profitability.

Shares in North Sea energy producers are rising in early trading in London, after Rishi Sunak confirmed that hundreds of new oil and gas licences will be granted in the UK.

Centrica, which last week put the sale of its UK North Sea natural gas fields on hold, has jumped 1.7% to the top of the FTSE 100 risers.

Independent oil and gas operator Ithaca Energy are up 2.2%, with Harbour Energy gaining 1.7%.

New CEOs at BT and Capita

It’s a Monday morning of job moves in the City.

BT has appointed board member Allison Kirkby as its first female chief executive, which will return the number of female CEOs at FTSE 100 companies back to 10, following Alison Rose’s shock departure from NatWest last week.

Kirkby will replace Philip Jansen by January 2024 at the latest.

She will take on a business that has seen more than £10bn wiped off its market value over the past four years, and which is planning to cut 55,000 jobs in the future.

Kirkby said:

“I’m incredibly honoured to have been appointed as the next Chief Executive of BT Group.

BT is such an important company for the UK, and our many customers both in the UK and internationally and is uniquely placed to help everyone benefit from the rapid advances in digitalisation. Our products and services have never been more important to how our customers live and work, and thanks to the significant investment BT is putting into digital infrastructure and in the modernisation of its services, I see us playing an even more important role going forward.

There’s also a shake-up at outsourcing firm Capita, where CEO Jon Lewis has decided to retire from the company by the end of the year.

He’ll be replaced by Adolfo Hernandez, currently the vice-president for global telecommunications for Amazon Web Services.

UK to grant new North Sea oil and gas licences

Rishi Sunak has confirmed that hundreds of new oil and gas licences will be granted in the UK.

As he heads to Scotland to announce funding for a planned carbon capture scheme in the region, the prime minister argues that Britain needs to strengthen its energy security.

In a statement, Sunak says:

“We have all witnessed how Putin has manipulated and weaponised energy – disrupting supply and stalling growth in countries around the world.

“Now, more than ever, it’s vital that we bolster our energy security and capitalise on that independence to deliver more affordable, clean energy to British homes and businesses.

“Even when we’ve reached net zero in 2050, a quarter of our energy needs will come from oil and gas. But there are those who would rather that it come from hostile states than from the supplies we have here at home.

“We’re choosing to power up Britain from Britain and invest in crucial industries such as carbon capture and storage, rather than depend on more carbon intensive gas imports from overseas – which will support thousands of skilled jobs, unlock further opportunities for green technologies and grow the economy.”

Rishi Sunak tells the BBC’s Good Morning Scotland that issuing hundreds of new oil and gas licences is “the right thing to do.”

He says: “Even when we reach net zero in 2050 a quarter of our energy needs will still come from oil and gas.”

— Ione Wells (@ionewells) July 31, 2023

Sunak is due to fly up to a critical energy infrastructure site in Aberdeenshire, Scotland today, to announce funding for a planned carbon capture scheme in the region.

He’s also insisted that banning people from flying is “absolutely the wrong approach” to tackling climate change, in a tetchy-sounding radio interview ….

Rishi Sunak not coming across his best on @BBCRadioScot

When GMS says he only has 5 mins, he said it was “a strange way to start the interview”

On flying to Scotland, he said: “If your approach to climate change is no one should go on holiday is completely and utterly wrong”

— Eleanor Langford (@eleanormia) July 31, 2023

The new consumer duty is the most significant change in conduct regulation in the last two decades, says David Morrey, financial services group partner at Grant Thornton UK.

Morrey says the introduction of the Duty today is “perhaps ‘the end of the beginning’,” and will prompt firms to take actions in four days:

-

Follow through on the implementation actions that weren’t ready for today – high on this list is producing the management information (MI) required to measure good outcomes.

-

Assurance so boards can ‘sleep at night’ as well as formally confirm every year that they comply with the Duty.

-

Closed book actions – the deadline for complying with the Duty on closed books is 31 July 2024.

-

Optimise – the FCA would call this embedding the right practices. It can also mean turning some of the tactical fixes of the past few months into something more robust (‘Consumer Duty by design’).

Consumer Duty which begins today would have prevented £40bn PPI misselling, @TheFCA Exec Director Sheldon Mills tells @Moneybox and admits consumers’ interests do not trump those of shareholders starts at 08’08”

— Paul Lewis (@paullewismoney) July 31, 2023

UK watchdog ready to pounce on firms harming consumes

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Britain’s financial watchdog is poised to pounce on any companies who aren’t giving customers a good deal, as new consumer protection rules come into force today.

The ‘consumer duty’ lays out clearer standards of consumer protection across financial services, sets a higher bar for financial firms and giving customers more certainty that products actually do what they promise.

It means firms must focus on delivering “good outcomes” for customers and preventing “foreseeable harm”, when selling products such as home loans and insurance.

You might hope that financial service providers already had their customers’ needs at the heart of their work, but those who have suffered a “poor outcome” know this isn’t always the case.

Nisha Arora, a director for consumers and competition at the FCA, said the consumer duty “raises the bar across all corners of finance”.

Arora says firms who are harming consumers are in the regulator’s sights, telling Reuters:

“We have been tracking those who are not ready or may not be ready and we will therefore be poised to take action and deal with firms who are not compliant and causing harm to consumers.

“Where we see fees or charges based on nothing, or products that have no value to them, or excessive fees… those are the things that will attract our attention.”

Rocio Concha, the director of policy and advocacy at the consumer body Which?, said the new regime was the FCA’s response “to what it sees as too many customers being ripped off in financial services”.

The new regime coincides with growing concern over “debanking” – where people or organisations have their bank accounts closed, typically with little or no explanation – after Nigel Farage said his account with the NatWest subsidiary Coutts was shut down because it disagreed with his political views.

More here:

Also coming up today

We discover how the eurozone economy performed this spring, when GDP data for the second quarter of 2023 is released. Economists predict the region grew by 0.2%, after failing to grow for the previous six months.

The Bank of England’s latest mortgage lending figues will show if rising interest rates have cooled the market, as borrowers brace for another hike in Bank rate on Thursday.

In the energy sector, Rishi Sunak is committing to pressing ahead with oil and gas exploration and production in the North Sea, despite concerns it will undermine the push towards net zero.

In another attack on green policies, ministers are considering restrictions on councils’ ability to impose 20mph speed limits, as Sunak insists he is on the side of motorists.

The agenda

-

9am BST: Italian GDP report for Q2 2023

-

9.30am BST: UK mortgage approvals and consumer credit data for June

-

10am BST: Eurozone inflation report for July

-

10am BST: Eurozone GDP report for Q2 2023

-

Noon BST: Mexico’s GDP report for Q2 2023